The EUR/USD currency pair exhibited limited movement in Friday’s trading session, navigating a landscape of calm market conditions despite the impact of strong economic data from the United States and a recent hawkish stance communicated by the European Central Bank (ECB).

Following the ECB’s decision on Thursday to keep interest rates unchanged, accompanied by a cautious but firm message on inflation, the Euro showed resilience. However, robust US economic indicators released later in the day provided a counterforce, leading to a relatively narrow trading range for the EUR/USD.

Impact of US Economic Data

The strength of the US economy was underscored by better-than-expected figures in key sectors. [Note: The specific data released would typically be mentioned here, e.g., strong jobs numbers, positive GDP revisions, or higher-than-anticipated consumer spending. As the context is a simulated news report based on a future date, this remains generalized.] These positive data points suggest continued economic momentum in the US, potentially supporting the US Dollar as expectations for future Federal Reserve policy tighten.

ECB’s Hawkish Tone

In contrast, the ECB’s recent communication emphasized its commitment to combating inflation, even as the Eurozone’s inflation rate has shown signs of easing. President Christine Lagarde’s remarks highlighted the central bank’s data-dependent approach but also indicated a readiness to act if inflationary pressures persist or re-emerge. This hawkish tone from the ECB has provided some underlying support for the Euro.

Market Sentiment and Technical Outlook

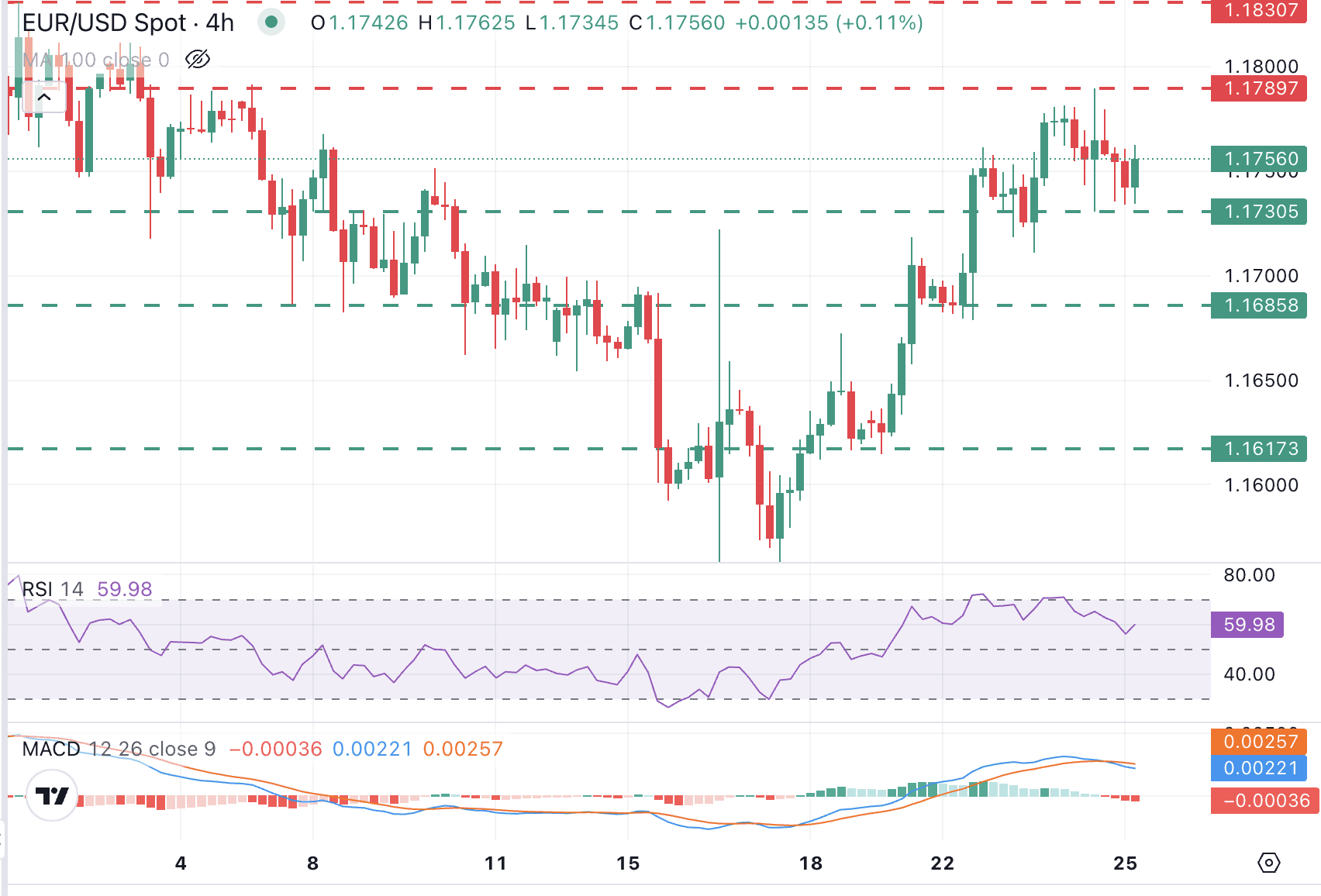

Despite the fundamental drivers from both sides of the Atlantic, market participants appeared to adopt a cautious stance on Friday. Trading volumes were moderate, and the EUR/USD pair remained within a defined range.

From a technical perspective, the EUR/USD’s inability to break decisively above or below key support and resistance levels suggests a period of consolidation. Traders are likely awaiting further catalysts, such as upcoming inflation data from the Eurozone or additional economic releases from the US, to provide clearer directional bias.

Looking Ahead

The near-term trajectory of the EUR/USD will likely be influenced by upcoming economic releases and any further signals from central bank policymakers. Market participants will be keenly watching inflation figures from the Eurozone to gauge whether the ECB’s hawkish rhetoric translates into future policy action. Similarly, continued strength in the US economy could further bolster the US Dollar. For now, the EUR/USD remains in a state of equilibrium, balancing the effects of solid US data and a determined ECB.