The European Central Bank (ECB) announced on Thursday that it would keep its key interest rates unchanged following its July policy meeting, a decision widely anticipated by markets. This marks a pause after a series of seven consecutive rate cuts, signaling a wait-and-see approach amidst a complex economic landscape.

The main refinancing operations interest rate, the marginal lending facility rate, and the deposit facility rate remain at 2.15%, 2.4%, and 2% respectively.

Key Drivers Behind the Decision

ECB President Christine Lagarde addressed the press, explaining the decision and outlining the policy outlook. A primary factor influencing the pause is the Eurozone’s inflation rate, as measured by the Harmonized Index of Consumer Prices (HICP), which has returned to the ECB’s target of 2% in June. While services inflation saw a slight uptick, overall domestic price pressures have continued to ease, with wage growth slowing.

Another significant consideration is the “exceptionally uncertain” global economic environment, particularly due to ongoing trade disputes between the United States and the European Union. Lagarde emphasized that the ECB does not target exchange rates but monitors them closely, acknowledging that a stronger Euro could potentially bring down imported inflation.

President Lagarde’s Commentary and Outlook

During her press conference, Lagarde noted that survey data points to a modest overall expansion in business activity. She highlighted that while a strong labor market, rising real incomes, and solid private sector balance sheets support consumption, higher tariffs and a stronger Euro are expected to make it harder for firms to invest. Defence and infrastructure investments are anticipated to bolster growth.

Regarding inflation, Lagarde expressed confidence that the “inflationary shock is behind us” and indicated that longer-term inflation expectations remain around 2%. However, she acknowledged that the outlook for Euro Area inflation is “more uncertain than usual” and stressed the bank’s commitment to a data-dependent, meeting-by-meeting approach. She also touched upon the trade tensions, stating that “retaliation is optional, not definite,” and that the full disinflationary or inflationary impact of tariffs cannot yet be determined.

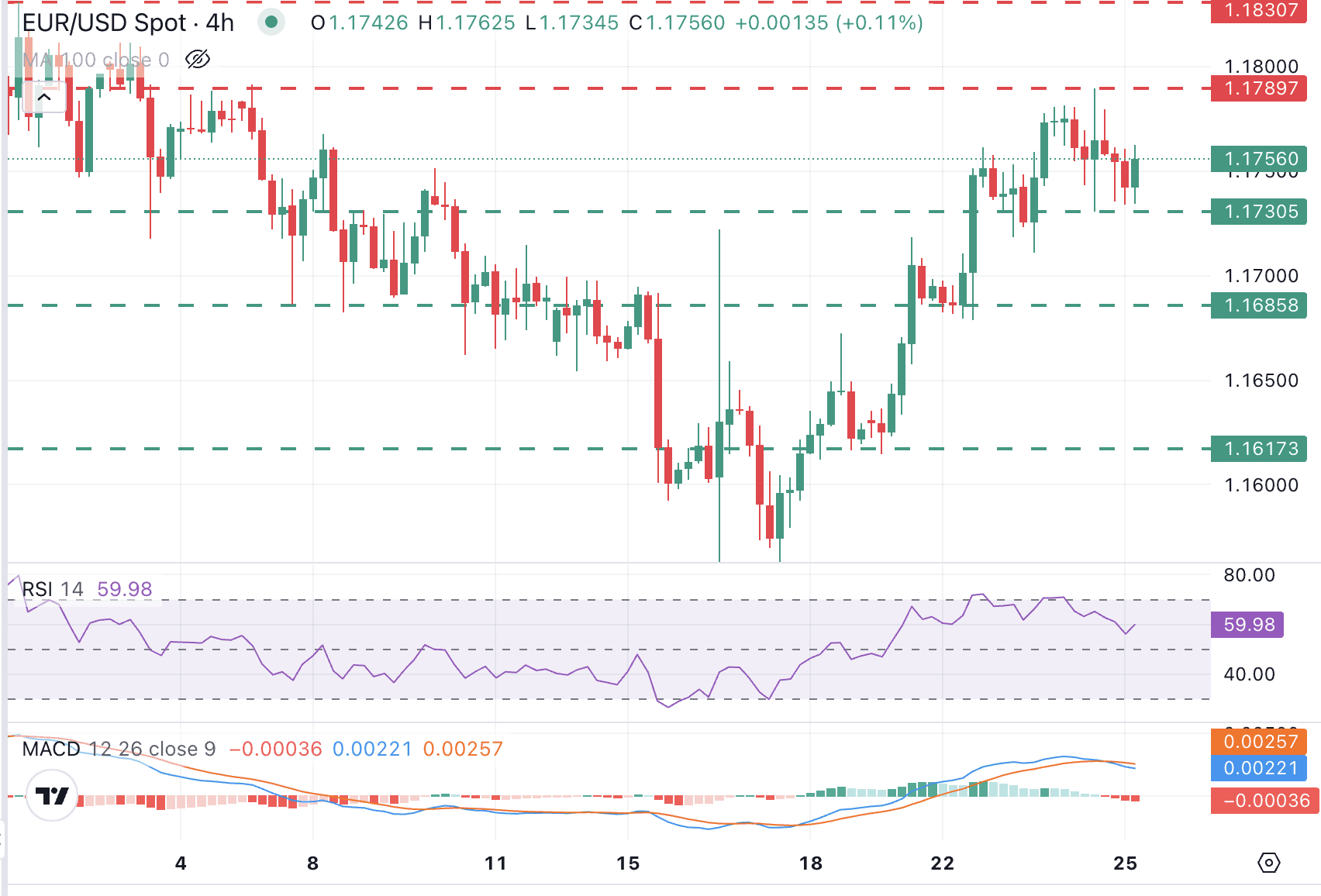

Market Reaction

Following the ECB’s policy announcements, the EUR/USD pair showed little immediate reaction, last trading around 1.1755, with a daily loss of 0.15%. Markets had largely priced in a no-rate-change decision, shifting focus to any forward guidance from the ECB regarding potential future rate adjustments later in the year. Analysts suggest that hints of a persistent disinflationary trend, despite tariff impacts, could revive expectations of year-end rate cuts, potentially impacting EUR/USD performance.

The ECB’s decision reflects a cautious stance, balancing the achievement of its inflation target with external economic uncertainties, particularly those stemming from international trade relations.